Will We See Housing’s ‘Hiccup’ Next Year?

Will We See Housing’s ‘Hiccup’ Next Year?

BCMC: Economic Forecast

Todd Tomalak, John Burns Real Estate Consulting

High labor costs are here to stay, and whoever wins labor will also win product choice, according to Todd Tomalak, senior vice president of research with John Burns Real Estate Consulting (JBREC).

“Labor availability and costs is a permanent problem requiring a fundamentally more productive solution,” says Todd. “We expect the slowing availability of labor to cause slower overall economic growth over future years as output growth comes from labor growth and productivity growth, with labor growth being hamstrung going forward.”

This leaves component manufacturers (CMs) in a great position to grow their market share with the reduced jobsite labor needs compared to conventional stick framing. Although CMs are also finding it difficult to fill positions in their manufacturing plant, advancements in technology and automation provide a viable labor-free alternative that can’t be found on the jobsite.

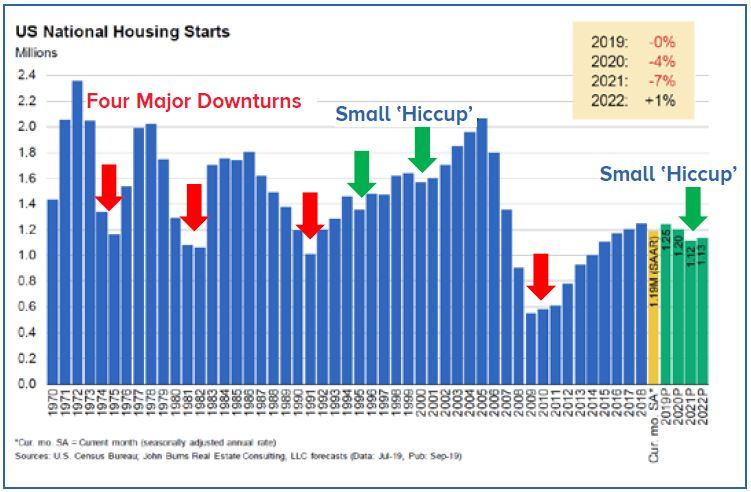

While CMs can help address overall issues attributed to labor in construction, JBREC predicts the housing industry will see a “hiccup” in 2020 and 2021 during the overall economic slowdown.

“We assume a mild recession as part of our ‘hiccup’ scenario,” Todd says. “We view housing as a well-positioned sector if the U.S. economy were to slow down, similar to the modest hiccup in housing when the U.S. faced a recession in 2001.”

Todd recommends CMs look at high-density SURBAN (urban-suburban) construction in secondary markets while doing homework on new markets. “High-density SURBAN is a pivot to urban features being brought to suburbs or smaller markets,” Todd says.

City dwellers are moving toward this lifestyle as it provides efficient use of land, and builders prioritize it because it is less risk and more homes per acre. CMs should also plan to see more remodeled homes than new construction for the next three to five years, and he recommends finding ways to add remodeling exposure into a CMʼs business model.