Editor's Message: Three Lessons Learned from 2020

Editor's Message: Three Lessons Learned from 2020

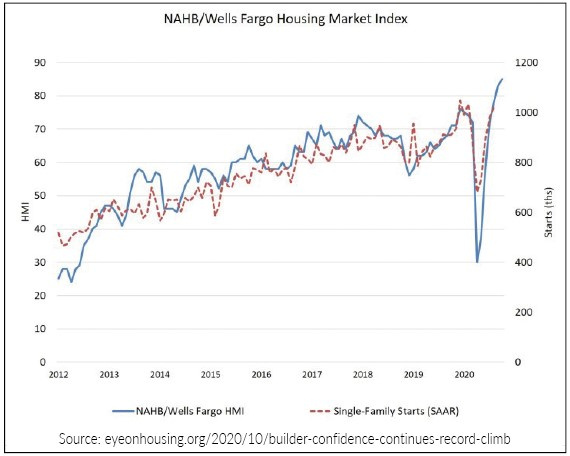

This year has been a wild ride in many different ways, none greater perhaps than what has occurred in the residential construction industry. Housing was going full bore at the end of 2019 and showed little indication of slowing as January flowed into February 2020. That changed when the pandemic prompted many governors to issue “stay-at-home” orders for all but essential workers, which caused a great deal of short-term uncertainty and housing starts to drop all the way to 2013 levels.

“V” may be for victory, but when a recovery is surprisingly shaped like one, it creates a host of challenges.

Fortunately, while the fall was dramatic, it had a much higher floor than most economists and housing experts had feared in March. For instance, by the end of March, John Burns Real Estate Consulting (JBREC) had downgraded every market in the country to “slow” or “very slow” with no sign of improvement. Yet by mid-April, those same forecasters (including JBREC) were expressing cautious optimism that everything from the flow of capital and new permits to actual jobsite activity looked positive.

They cautioned that there was still a lot of uncertainty caused by the broader pandemic-related economic upheaval. There was considerable debate amongst analysts in April and May, whether they were from Wall Street, Wells Fargo, or NAHB, about what shape the housing recovery would take. While an option, few predicted the swift, “V-shaped” recovery housing experienced. Fewer still anticipated housing starts would try to reach pre-pandemic levels by the end of July.

That meteoric return caught some in the construction industry flat-footed. It exposed the parts of the residential supply chain that don’t pivot on a dime. It also challenged everyone, from architects to component manufacturers (CMs), to figure out how to ramp up with remote workers and social distancing practices in place, which was complicated by the fact that a portion of the workforce was either fearful, or artificially unmotivated by federal assistance, to go back to workplace. So what lessons can the component manufacturing industry take away from the boom-bust-boom, pandemic-laden chaos that was 2020?

There are many lessons learned but if sorted into broad categories they probably fall into one of these three areas:

- Workforce flexibility: One common theme from CMs who felt they navigated the slowdown successfully was their swift adoption of technologies like Zoom video conferencing and other applications that allowed for online collaboration and communication. Going forward, the ability to use technology to incorporate remote workers with more fluid schedules will enable CMs to attract a whole new category of worker. As you figure out what this looks like for your company, it’s important to consider the hiring advice Dolly Penland offers in this issue (page 26).

- Closer collaboration: In 2019, SBCA engaged in the Construction Industry Workflow Initiative (CIWI), which began an exploration of how the construction industry functions and where CMs fit into the whole process. While the CIWI is an excellent workforce development tool to help new hires understand the industry, it also provides an excellent illustration of how much CMs have to gain by building closer partnerships throughout the supply chain. As one example, the leadership of the National Framers Council (NFC) and SBCA provide a compelling argument in this issue (page 12) on why all CMs should be re-examining their relationships with the framing contractors in their market.

- Diversification: The construction industry has roared back and appears to be on a healthy trajectory for the foreseeable future. Nevertheless, just as death and taxes are unavoidable, so too is the next housing downturn. Being an incredibly efficient operation is probably the most import factor in weathering the next lull but close behind that is ensuring you have diverse product and service offerings for a broad spectrum of clientele. We have highlighted Shelter Systems Limited a lot over the years, and there’s a good reason why — they keep providing success stories from their willingness to push the envelope. The cover feature this month (page 16) is another example of how their continual efforts to diversify their customer base and the types of projects they supply provides a roadmap all others CMs can follow toward success.