Do National Builders Want CMs to Be Commodity Suppliers?

Do National Builders Want CMs to Be Commodity Suppliers?

BCMC Session: What It Takes to Partner with a National Builder

Chad Nuessle, Lennar • Kemp Gillis, Lennar • Doyle Headrick, Production Framing Inc

Jason Walsh, California TrusFrame LLC

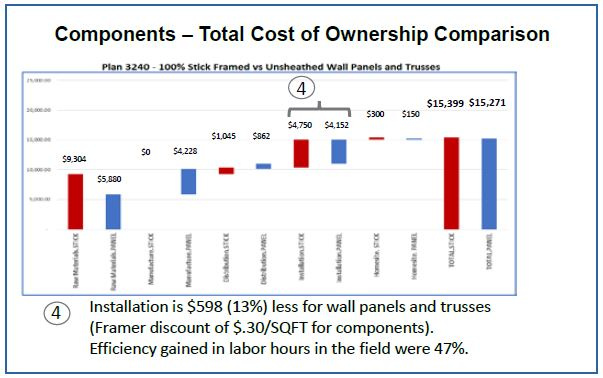

Total Cost of Ownership (TCO) is a concept now being employed by some national builders to help them understand their suppliers’ and trades’ costs better. Their goal is to address home affordability and, from their perspective, TCO is one tool they have developed to produce a more cost-efficient product.

In essence, TCO provides builders greater transparency into their suppliers’ operations and offers insights into suppliers’ cost structures that determine the final cost of each product and service used in the construction of a home. In return for this greater transparency from suppliers, builders commit to certain production volume levels over a pre-established period of time. Beyond the obvious benefit of volume to cover fixed overhead costs, this approach also provides a more predictable allocation process, allowing the supplier to forecast production up to 90 days in advance.

For component manufacturers (CMs), TCO offers an opportunity to fill capacity with a trusted partner with margins that are consistent for established periods of time. Another big advantage is evening out fluctuations in commodity costs, which are typical of lumber and steel markets. Developing a financial model, with trailing averages over a determined number of days based on Random Lengths or other third party metrics, allows margins to be much more predictable, regardless of commodity market movement. This removes some of the stress associated with large market fluctuations. Of course this also means CMs are not able to take advantage of “buy low, sell high” gains either.

This model encourages builders to collaborate with CMs and other suppliers, offering insights that can drive down expenses and provide the opportunity to share in any savings derived from the efforts.

Opponents to TCO argue it gives builders too much financial insight into a CM’s business and creates potential for the builder to treat a CM’s products as commodities. This is contrary to the value-added approach most CMs currently use in their market development. There is also the potential risk with TCO that a CM will be less able to provide for greater investments in personnel growth and new equipment because it won’t be a priority for the builder customer. Yet those who participate in TCO agreements argue the insights they gain from the deep dive into their costing models benefits their business, and the production capacity secured through TCOs allows them to fill the remaining capacity with projects that are unique, innovative, and allow for a much higher margin.

While it is likely TCO prevents a CM from earning high margins on certain projects, it also prevents a CM from losing money on projects since these builders are looking for mutually beneficial, long-term relationships.